Financial results of year 2021

The purpose of the current press release is to present the Group’s financial results for the fiscal year 2021.

FINANCIAL RESULTS OF YEAR 2021

ATHEX: PLAT

Reuters: THRr.AT

Bloomberg: PLAT GA

Full Year Highlights:

- Strong performance in terms of Turnover (+26.1%) and EBITDA (+43.2%) from continuing operations, mainly due to the performance of the Technical Fabrics sector.

- Strong Earnings before Taxes (EBT) of € 83.9 million, deriving mainly from the traditional sales mix as well as from sales of personal protection related products.

- Strong free cash flows and increased liquidity with Net Cash of € 9.3 million.

- Implementation of an extended investment plan for the 3-year period 2020 – 2022, with estimated cash CAPEX of € 101 million, mainly financed with own funds.

- Distribution of interim dividend of ~€0.11 / share – imminent proposal of an annual dividend towards the General Meeting of Shareholders.

The purpose of the current press release is to present the Group’s financial results for the fiscal year 2021.

The Group's Turnover from continuing operations amounted to €428.4 million, increased by 26.1% compared to 2020, while Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) from continuing operations amounted to €103.8 million, higher by 43.2%, compared to the previous year. Also, Earnings before Taxes (EBT) from continuing operations amounted to €83.9 million, increased by 61.1% compared to the year 2020. It should be noted that according to estimates of the Management for the year 2021, Earnings before Taxes at the Group level, related to the products of the existing portfolio used in personal protection and health applications, amounted to € 51.8 million.

In terms of liquidity, the Group further improved its liquidity position by attaining a Net Cash of € 9.3 million, as the cash and cash equivalents exceeded loan liabilities. The total Equity on 31.12.2021 amounted to € 252.3 million compared to € 176.1 million on 31.12.2020.

More specifically, the following table depicts the main financial figures from continuing operations of the Group during the year 2021 in relation to the corresponding period of 2020. It is noted that the discontinued operations concern the termination of production activities of the US subsidiary Thrace Linq Inc.

|

CONSOLIDATED FINANCIAL RESULTS (in € thous.) |

31/12/2021 |

31/12/2020 |

Change (%) |

|

Turnover (Continuing Operations) |

428,429 |

339,722 |

26.1% |

|

Gross Profit (Continuing Operations) |

140,149 |

105,959 |

32.3% |

|

ΕΒΙΤ* (Continuing Operations) |

83,913 |

53,857 |

55.8% |

|

EBITDA* (Continuing Operations) |

103,791 |

72,484 |

43.2% |

|

Adjusted EBITDA* (Continuing Operations) |

105,799 |

76,559 |

38.2% |

|

EBT (Continuing Operations) |

83,920 |

52,077 |

61.1% |

|

Earnings after Taxes (Continuing Operations) |

65,866 |

41,272 |

59.6% |

|

Earnings/(Losses) after Taxes (Discontinued Operations) |

6,591 |

-3,316 |

|

|

Earnings after Taxes (Total Operations) |

72,457 |

37,956 |

90.9% |

|

Earnings after Taxes and Non-Controlling Interests (Continuing Operations) |

65,436 |

40,663 |

60.9% |

|

Earnings/(Losses) after Taxes and Non-Controlling Interests (Discontinued Operations) |

6,591 |

-3,316 |

|

|

EATAM (Total Operations) |

72,027 |

37,347 |

92.9% |

|

Basic Earnings per Share (Continuing Operations) (in €) |

1.5093 |

0.9314 |

62.0% |

|

Basic Earnings / (Losses) per Share (Discontinued Operations) (in €) |

0.1520 |

-0.0760 |

|

|

Basic Earnings per Share (Total Operations) (in €) |

1.6613 |

0.8555 |

94.2% |

The fiscal year 2021 was a year of strong financial performance as the Group achieved a higher profitability by successfully offsetting the negative impact from the significant increase seen in raw material costs and the volatility observed in terms of market demand. More specifically, the following were observed during the year:

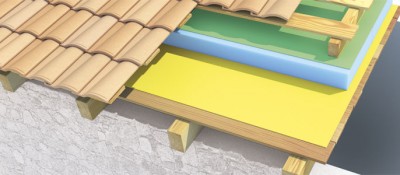

- Increase of demand for products in the construction sector.

- Significant demand in the infrastructure and agricultural sector.

- Significant demand for products related to personal protection and health, especially during the first months of the year, but with a significant decrease in the second half.

- Gradual increase of raw material prices, while their high levels remained throughout the year. In individual cases some additional increases were observed, depending on the type of raw material and the geographical area.

- Constantly increasing energy costs, especially during the last quarter of the year, in all countries which the Group is operating in.

- Significantly higher transportation costs with significant lack of capacity in both available ground transport and containers.

- Significantly increased cost with regard to auxiliary materials as well as packaging materials.

Assessing the impact of the pandemic in the future and prospects of the Group

Regarding the first quarter of 2022, the Management of the Group remains optimistic for its satisfactory performance, given the difficult conditions prevailing in the current period. It is estimated that a significantly stronger profitability will be achieved, compared to the corresponding period before the pandemic, but it will settle lower than the profitability of the corresponding period of the previous year. However, the comparison with the previous year becomes extremely difficult to be substantiated, due to the extraordinary circumstances of both that period and the current one.

Regarding the course of 2022 as a whole, the very challenging as well as volatile macroeconomic environment described above makes especially difficult the development of any financial estimates, since the visibility for the financial results and the level of demand in the coming months remains extremely limited. However, the great effort made by the Management of the Group as well as the Management of the subsidiaries in all the countries of operation, creates conditions of reserved optimism that the Group will be able to implement its strategic plans and to maintain to a significant extent the profitability from the traditional portfolio that was formed in 2021. This will be also demonstrating that the Group has entered a new era, characterized by significantly higher profitability compared to pre-pandemic levels. It should be noted, however, that although the implementation of this plan is the fundamental goal of the Management, the extremely uncertain conditions that arise at the time of preparation of the annual report are likely to redefine the annual performance estimates made by the Management in the coming months of the year.

With regard to the financial results, Mr. Dimitris Malamos, Chief Executive Officer of the Group, commented: “2021 has been a milestone year for the Group as we achieved a strong financial performance, we strengthen our financial position, while continuing at the same time to implement our investment plan.

The strong financial performance of the past two years provides us with the ability to uninterruptedly implement our extended investment plan, which will exceed €100 million over the period 2020 – 2022, and at the same time we place special emphasis on the aspects of environment and social contribution.

Despite the fact that the current developments on global level create conditions of great concern, we are confident that the Group’s trajectory up until today has set the foundations in order to attain even higher profitability levels compared to the ones of the pre-pandemic era, thus confirming that the Group remains in a course of further development and growth.

For further clarifications or information regarding the present release you may refer to the Department of Investor Relations and Corporate Announcements, tel.: + 30 210-9875081.